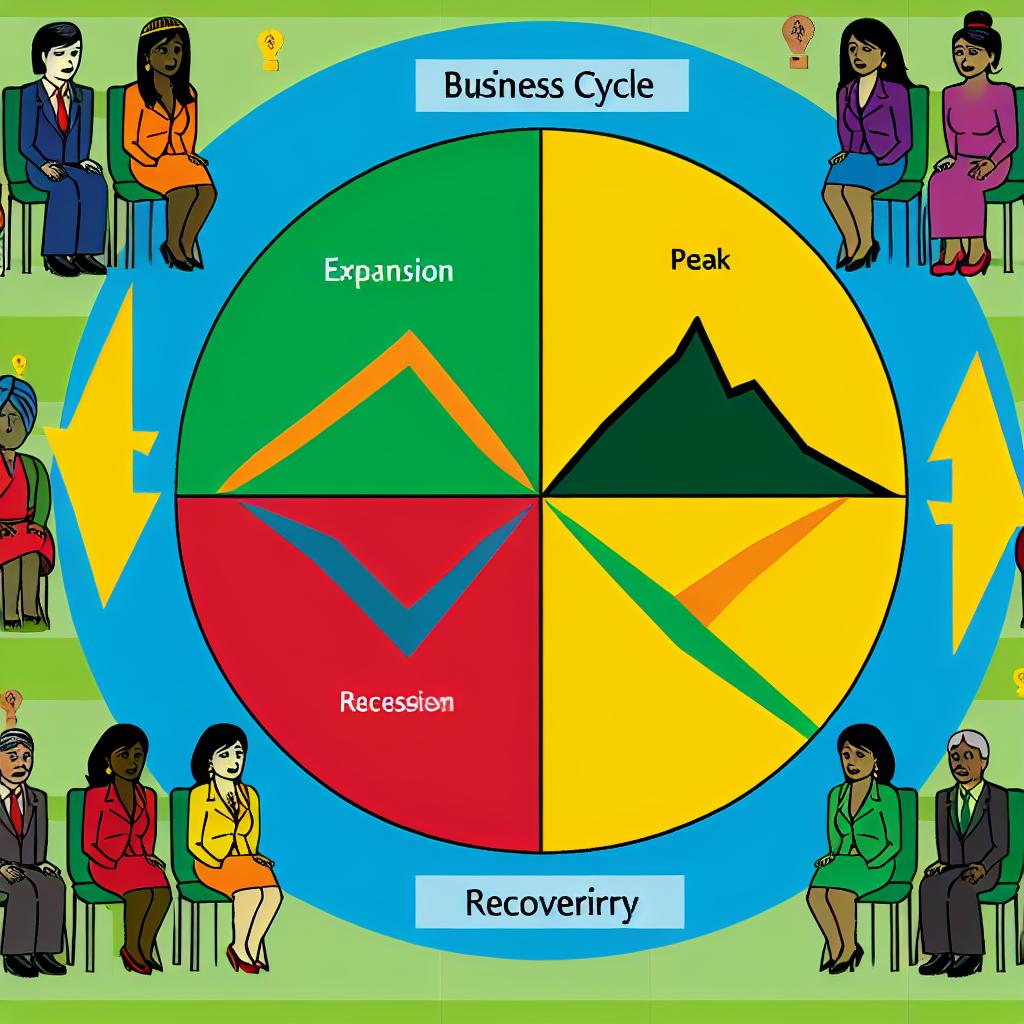

Understanding the Business Cycle

The business cycle is a fundamental concept in economics, describing the fluctuations in economic activity that economies experience over time. Its recognition and understanding provide insight into the rhythmic nature of economies, allowing for better-informed economic policies and strategic business decisions. Generally, the business cycle is divided into four phases: expansion, peak, recession, and recovery. These phases reflect a pattern of growth and contraction within an economic system, influenced by various factors including consumer behavior, market dynamics, and governmental policies.

Expansion Phase

The expansion phase represents a period of economic growth and is often anticipated with optimism due to its many positive outcomes. During expansion, there is a noticeable improvement in several economic indicators indicating robust economic health. Key among these indicators is the Gross Domestic Product (GDP), which typically shows substantial growth as consumer spending and investment rise. In this phase, businesses often increase their capital investments, signifying confidence in continual economic flourishing. Employment rates are another area of improvement, as the demand for labor surges to meet increased production and service needs.

The expansion phase is characterized by several hallmark features, including:

Growing consumer demand: Consumers feel more secure about their financial future, often resulting in higher expenditure on goods and services.

Increased industrial production: As demand rises, industries ramp up production to meet consumer and market needs, leading to heightened manufacturing activities.

Rising employment levels: With an increase in demand and production, businesses require more workforce, thus reducing unemployment rates.

However, this phase does not last indefinitely and typically continues until the economy reaches a peak. It is at this peak point that the expansion can potentially lead to overheating, manifesting as inflationary pressures.

Peak

At the peak, the economy operates at its maximum sustainable output, with economic indicators at their optimum points. Despite the apparent stability, this phase can herald vulnerabilities such as inflation or asset bubbles. These arise when increased demand leads to price rises, straining economic resources and purchasing power. Recognizing the peak is critical for policymakers and businesses as this knowledge can encourage prudent economic management, helping to avoid abrupt downturns.

Recession Phase

A recession is marked by a substantial decline in economic activities lasting more than a few months, reflective of a period of downturn following the peak. This phase is evident in reduced GDP, diminishing income levels, declining employment, dropping industrial production, and decreased retail sales. A decrease in economic activity typically follows the peak phase and persists until the economy hits a trough.

Recessions are defined by:

Decline in consumer and business confidence: During recessions, financial uncertainty heightens, leading to decreased spending from both consumers and businesses.

Reduction in investment and spending: Faced with economic uncertainty, businesses often scale back investments, while consumers become more reserved in their spending habits.

Rising unemployment rates: As businesses strive to maintain profitability amidst falling demand, layoffs and hiring freezes contribute to higher unemployment rates.

For businesses, navigating a recession requires strategic planning to maintain profitability and survive the downturn. Policymakers often endeavor to counteract the impact through monetary and fiscal interventions aimed at stimulating economic activity and encouraging growth.

Trough

The trough represents the lowest point of the recession period, signaling a transition toward recovery. When an economy reaches its trough, it signifies the stabilization necessary for revival, indicating that the worst of the economic contraction has passed. For policymakers and investors, this is a critical juncture as it marks the beginning of potential growth and recovery efforts.

Recovery Phase

In the recovery phase, the economic landscape begins to improve, emerging from the recessionary downturn. Economic indicators such as employment and production begin showing positive changes, driven by renewed business and consumer confidence. Employers restart hiring, and investments in business ventures slowly pick up pace as optimism returns to the economic framework.

Key characteristics of the recovery phase include:

Gradual increase in consumer spending: As economic stability returns, consumers regain confidence, leading to increased spending on goods and services.

Improvement in employment figures: Businesses ramp up hiring as demand increases, contributing to declining unemployment statistics.

Stabilization and growth in business investments: Investment activities begin to recover as businesses foresee potential returns, driving further expansion.

The recovery phase, as confidence grows, smoothly transitions into another cycle of expansion, perpetuating the continual nature of the business cycle and setting the stage for future economic performance.

Conclusion

An understanding of the business cycle is crucial for both businesses and policymakers. Recognizing the signs and stages of each phase of the cycle is essential in devising effective strategies that address economic challenges and harness potential opportunities. Decisions related to investments, regulations, and fiscal policies can be significantly informed by insights into the business cycle, allowing stakeholders to anticipate and adjust to economic changes effectively.

For those seeking further exploration or detailed data on business cycles, reputable resources such as the Federal Reserve and the World Bank offer extensive analysis and comprehensive reports that can enhance understanding and strategic planning.

This article was last updated on: March 31, 2025