What is National Debt?

The national debt represents the cumulative total of all the money that a country’s government has borrowed to sustain its expenditures and meet its financial obligations. This borrowing generally occurs through the issuance of securities, including bonds and treasury securities, to domestic and international investors. When government spending surpasses revenue collection, it results in the need for additional funds, prompting borrowing. This debt is essential for managing gaps in the budget arising from such fiscal imbalances.

Components of National Debt

The national debt can be broadly categorized into two primary segments, each serving different roles and involving distinct stakeholders.

1. Public Debt: This represents the portion of the national debt owned by various external entities. These include private individuals, corporations, foreign governments, and institutions. Public debt functions as a critical tool for investment, enabling these entities to purchase government securities, which, in turn, provide the government with the liquidity necessary to address its immediate financial commitments.

2. Intragovernmental Holdings: Unlike public debt, intragovernmental holdings involve debt that the government owes to itself. This typically arises from obligations to federal trust funds, most notably Social Security and Medicare. The funds accumulated in these trust accounts are often utilized by the government for various projects, thus creating an internal debt obligation. These combined amounts from both categories constitute the total national debt that the government is responsible for managing.

How is National Debt Managed?

The management of national debt is a complex and ongoing process involving the issuance of various debt instruments. Key amongst these are:

Treasury Bills: Known for their short-term nature, treasury bills are debt instruments that mature in one year or less. They are frequently used for immediate financial needs and are a popular choice for investors seeking quick returns with minimal risk.

Treasury Notes: These are medium-term securities, with maturity periods ranging from two to ten years. They offer a balanced approach for investors, providing a moderate level of security and predictable interest payments over a reasonable time frame.

Treasury Bonds: These long-term securities have maturities extending beyond ten years. They are ideal for investors eyeing long-term stability and consistent interest income. By selling these securities to various investors globally, the government secures essential funds. Simultaneously, investors benefit from regular interest payments, making this a mutually advantageous arrangement.

Understanding Budget Deficits

Budget deficits occur when a government’s expenditures in a given fiscal year exceed its revenue collection. While such deficits are occasionally inevitable, understanding their causes and implications is vital to formulating effective fiscal policies.

Causes of Budget Deficits

A confluence of factors can precipitate budget deficits, each influencing the economic landscape differently.

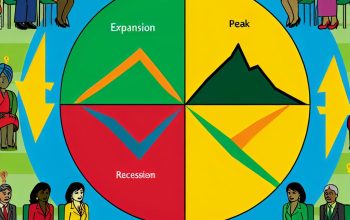

Economic Downturns: During periods of economic struggle, government revenues typically contract as tax inflows decrease. Concurrently, social welfare programs often require increased funding, exacerbating fiscal shortages.

Fiscal Policy Choices: Deliberate governmental decisions to escalate spending without matching revenue increases are a direct cause of budget deficits. Such choices might reflect policy priorities favoring immediate economic or social investments over monetary balance.

Unexpected Expenses: Events beyond government control, such as natural disasters or global health emergencies, necessitate additional spending. These unforeseen expenditures can swiftly deplete financial reserves, leading to deficits.

Impact of Budget Deficits

Persistent budget deficits pose multiple challenges, primarily through their propensity to necessitate ongoing borrowing. Each deficit increment potentially aggravates the national debt, imposing a strain on the country’s overall economic framework. Though some analysts argue that strategic short-term deficits can fuel economic recovery during downturns, unchecked long-term deficits tend to provoke inflationary pressures. They can also elevate interest rates, which might curb investment and inhibit broader economic growth over time.

Reducing Budget Deficits

Addressing budget deficits demands a multifaceted strategic approach, with several potential avenues for resolution.

Spending Cuts: Implementing reductions in public spending stands as a direct strategy to mitigate budgetary imbalances. Such fiscal adjustments often require careful prioritization to minimize adverse social impacts.

Tax Increases: By raising taxes, governments can augment their revenue streams, making it a traditional method to counterbalance deficits. However, tax hikes can be contentious and potentially impact economic behavior.

Economic Growth: Fostering conditions conducive to economic expansion offers a dynamic solution. As the economy grows, tax revenues generally increase organically, reducing deficits without necessitating immediate tax rate adjustments.

For a comprehensive exploration of national debt and budget deficits, resources prepared by financial institutions and government entities provide invaluable insights. Those interested in delving deeper may visit the TreasuryDirect and Congressional Budget Office websites for further reading. These platforms offer extensive data and analysis, aiding in the understanding of national and budgetary fiscal dynamics.

This article was last updated on: April 21, 2025